Official figures published: China installed 12.92 GW of solar PV capacity in 2013; Shift to distributed generation in 2014

Late April 2014, China’s National Energy Administration (NEA) announced that a total of 12.92 GW of solar PV capacity were installed in 2013. However, this figure is incomplete, since data from provinces like e.g. Jilin and Tibet were not included, Solar Server’s partner Asia Europe Clean Energy (Solar) Advisory Co. Ltd. (AECEA) notes.

According to the official statistics, 12.12 GW fell into the category of large-scale, whereas the remaining 801 MW belonged to distributed solar PV projects.

50 MW solar photovoltaic power plant in China’s Gansu province. A total of 3842 MW were installed here in 2013. Image: Trina Solar

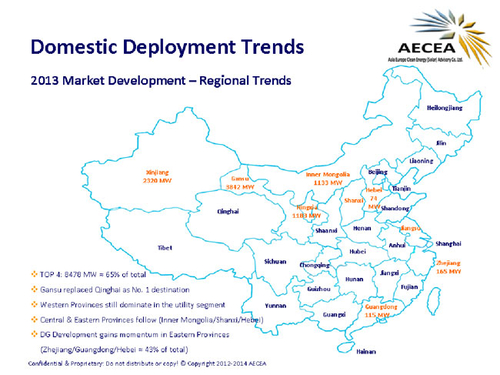

Last year’s outperforming provinces were Gansu (3842 MW); Xinjiang (2320 MW) Ningxia (1183 MW) and Inner Mongolia (1133 MW), i.e. these four out of a total of 22 provinces installed 65% of all large-scale power plants. In comparison, in the same provinces less than 50 MW of distributed solar PV (0.3; 7; 40; 0.6 MW) were installed.

Provincial quotas for large-scale PV projects may be exceeded

Given the central government’s intention to strongly promote distributed solar PV compared to utility-scale power plants, last years top 3 provinces were Zhejiang (165 MW), Guangdong (115 MW) and Hebei (74 MW), which accounted for approx. 43% of the total installed distributed power. In this context, AECEA is looking forward to how e.g. Gansu province which achieved a record installation of 3.8 GW last year, will according to its 2014 quota for large-scale system slow down to a mere 500 MW and whether some policy adjustments will follow in the next couple of months. To date, early signs are already visible that provincial quotas for large-scale projects are about to be exceeded.

Shift to distributed power in 2014

Against the background that in January 2014 the NEA set a target of 8 GW distributed power for 2014, thus aims at a 10 times increase YoY. However, given the administrative, financial and operational complexity of distributed solar PV compared with large-scale ground mounted solar PV, AECEA is not surprised that in the first months of 2014 distributed solar installations fell very short of expectations. Therefore, in order to ensure a realization of the 8 GW target, the central govt. is expected to issue further regulations designed to facilitate a faster execution of such projects in the remaining months of 2014. AECEA anticipates that such supplementary regulations will be announced in the remaining weeks of June. Assuming that the supplementary regulations will be released it allows for a faster execution of distributed projects, AECEA remains confident that the 8 GW target could be achieved. As a first sign, the State Administration of Taxation of China announced on June 11th to have adjusted its tax policy for distributed solar PV effective July 1, 2014.

China aims at 70 GW of Solar PV by 2017

In a further attempt to address China’s nationwide prevailing air pollution, already in March this year the National Development and Reform Commission (NDRC) approved an “Air Pollution Prevention Plan”. Released early May, the focus of this plan is China’s power sector and numerous targets were set, e.g. emission reduction, grid extension, coal consumption, etc. among others. Accordingly, this “plan” stipulates a 70 GW solar PV power generation capacity target by 2017. The target itself shall be made up equally by large utility-scale and distributed solar PV power plants and identifies as well key target regions for both types of applications.

The “new” official target represents a 100% increase of what China aimed at so far by the end of 2015, which coincides with the ongoing 12th Five-Year-Plan (2011-2015). As of today, China’s long-term target stipulated in official documentations, i.e. 50 GW by 2020 remains unchanged, although in discussions with governmental representatives a 100 GW target by 2020 is considered. Given the new target of 70 GW by 2017, AECEA is of the opinion that by the end of 2020 China could hold a total of 130-150 GW installed solar PV power generation capacity. However, taking into account the country’s pressing need for clean power generation capacities and China’s Electricity Council recent announcement that possibly by 2030 no further coal fired power plant will be constructed; an impressive 200 GW by 2020 doesn’t appear to be too unrealistic.

China encourages the society to invest in 30 distributed solar PV projects

Mid May, China’s National Development and Reform Commission (NDRC) published an official document outlining in total 80 energy, information, and infrastructure projects explicitly encouraging the “society” to invest in. [Note: the word “society” is being taken to mean “private investors which includes both domestic and foreign”.] The 80 projects cover solar, hydro, and wind power, oil and gas pipelines, railway and subway lines.

Responsible for US$3 trillion of outstanding debts as of June last year, related investments made by state-owned companies and provincial and city governments, have been criticised by analysts for being largely inefficient. Therefore, allowing more private investment in China's centrally planned economy is an important part of the government's plans to reduce it own intervention and let market forces play a bigger role. The 80 projects are seen as parts of reforms to open and increase privatisation in previously monopolised infrastructure sectors. The official statement suggests a further opening of the energy and infrastructure sector in the future.

China is attempting to move its PV market from primarily utility-scale PV in Northwestern China to primarily distributed PV in densely populated areas in the East, North and South.

Proportion of distributed solar PV projects reflects growing importance on China’s energy agenda and political pressure as well

Interestingly, out of 80 projects, more than half are energy-related and a staggering 30 projects are so-called “distributed solar PV project demonstration zones”. The investments shall be used for both construction as well asoperation and could be done in the form of Joint Ventures, wholly owned entities, or franchise. The significant proportion of distributed solar PV projects reflects not only their growing importance on China’s energy agenda, but as well the political pressure to seek near-term solutions for the myriad of constraints faced by investors aiming at developing such projects. Given the fact that the central government is clearly favouring distributed solar PV, however the lack of domestic experience, e.g. the Golden Sun program was based on a different business model compared to today, whereas today such projects are subject to a FIT and therefore have to achieve the maximum possible in terms of generated kWh, in order to achieve a certain IRR.

AECEA argues that all 30 distributed solar PV projects combined in comparison to subway line No: 16 in Beijing which is open for the “society” too, undoubtedly requires significantly less investment. Therefore, AECEA is of the opinion that the governments intentions to offer 30 distributed solar PV projects is not necessarily a lack of funding, but rather the governments immediate need to learn how e.g. foreign companies finance, plan, design, construct, operate and maintain such projects, given their multiple years of experience compared to their domestic peers. Given the high-level of political attention to all 80 projects, it is fair to assume that it is in the interest of the government to provide relatively “risk free or safe bet” projects for both domestic and foreign companies.